Revolutionary

New Workflow

Step 1

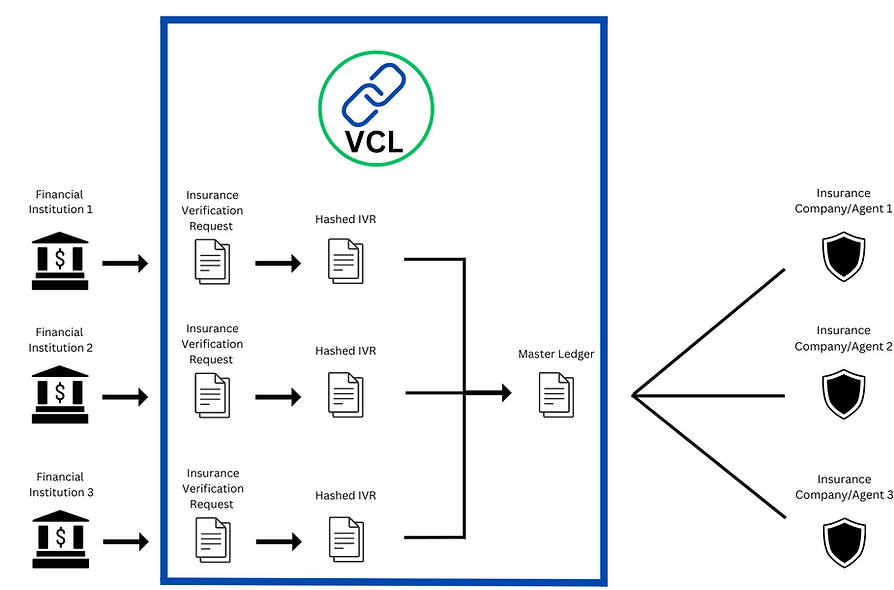

VINChainLedger makes use of a daily, distributed ledger. Financial Institutions are now able to send insurance verification requests to one central database, eliminating the need for complex distribution channels.

Step 2

Financial User uploads .CSV file with VIN of requested vehicle and contact information where VOI can be sent. VinChainLedger takes the CSV file and hashes the VIN. This ensures security since hashes are one way functions.

Step 3

VINChainLedger compiles all individual Financial User's .CSV uploads, and compiles them on a Master Ledger that is displayed publicly.

Step 4

Master Ledger is utilized by Insurance Providers/Agents by way of internal crawling software built in to VinChainLedger to look for matches. Providers/Agents are also able to download the Master Ledger and utilizes their own proprietary systems to crawl the list as well

Old Work

Flow

*When Things Go

Perfectly

Old Work

Flow

*When Things Go

Wrong

Ways the Old Process

Goes Wrong

- Consumer Changes Insurance Carrier

- Consumer Purchases or Sells A Vehicle

- Consumer Moves or Changes Mailing Address

- Consumer Doesn't Know Exactly Who Loan Is Through

- Consumer Throws Away Monthly, Mailed Loan Documents

- Consumer Throws Away Monthly, Mailed Loan Documents

Benefits of

VINChainLedger

Financial

Institutions

- ONE Central Location For ALL Insurance Request

- Avoid Mailing Costs

- Avoid Lost Mail

- Avoid External Security Issues

- Maintains "Good Faith" With Consumer

Consumer

- Time and Task Saver

- Gets Cut Out Of Communications

- No Surprise "Force-Placed" Insurance

Insurance

Provider/Agent

- Happier Customers

- Fast and Timely - No Back Dating Permissions

- Maintains "Good Faith" With Consumer